Ericsson trial new mobile money scheme across 7 European countries

Swedish mobile technologies giant Ericsson have seen fit to leverage their wide-spread presence in the mobile industry and take a step into the consumer market with the launch of a new mobile money scheme. Think of this new scheme partly as a mobile to mobile PayPal service, it’s more than that but you get the idea.

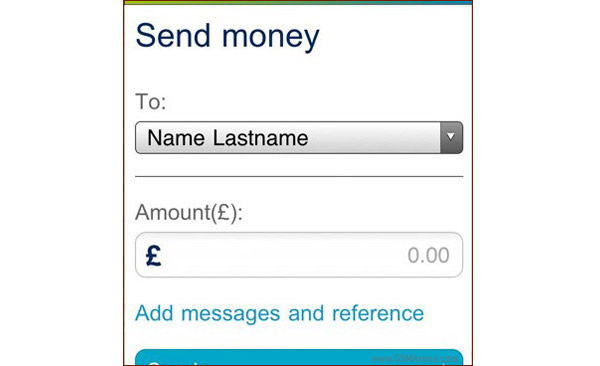

Dubbed ‘Ericsson Money’, the service will allow participants to send or receive money and even withdraw cash. Once you’ve signed up you can add money to your e-wallet via credit/debit card or bank transfer and there’s even the option to link your account to a prepaid Ericsson Money MasterCard for making purchases. As with online banking you can send or receive funds from anyone else using Ericsson Money and it’s accessible 24 hours a day. The idea is to make it easier to pay for, well effectively anything from wherever you are.

Ericsson said that this was the “first step toward bringing a full suite of convenient, cost-efficient, secure and instant mobile financial services to consumers globally.” And this is only the start, “Simply having a friend’s phone number, irrespective of where he or she is in the world, will open up access to financial services and mobile money in a new way,” said Semir Mahjoub, Ericsson VP and President of Ericsson Money Services. It wouldn’t be surprising if this service aimed to make use of NFC technology too as it evolved.

Currently the new Ericsson Money scheme is being trialed in 7 countries across Europe: the UK, France, Italy, Spain, Germany, Sweden and Poland, so assuming you qualify and you want to become one of the first users of the service, you can find out more or sign up here. Let us know what you think about the progression to automated, digital mobile payment systems, does it scare you, excite you, intrigue you or otherwise, we’d love to hear your thoughts in the comments.

Featured

Categories

- Mobile phones

- Mobile software

- Mobile computers

- Rumors

- Fun stuff

- Various

- Android

- Desktop software

- Featured

- Misc gadgets

- Gaming

- Digital cameras

- Tablets

- iOS

- Desktop computers

- Windows Phone

- GSMArena

com - Online Services

- Mobile Services

- Smart Watches

- Battery tests

- BlackBerry

- Social Networks

- Web Browsers

- Portable Players

- Network Operators

- CDMA

- Windows

- Headphones

- Hands-on

Oppo R7 battery life test

Oppo R7 battery life test Hot or Not: Android M, iOS 9 and Watch OS 2.0

Hot or Not: Android M, iOS 9 and Watch OS 2.0 Samsung Galaxy S6 updated to Android 5.1.1: exploring the differences on video

Samsung Galaxy S6 updated to Android 5.1.1: exploring the differences on video Benchmarking Asus ZenFone 2 ZE551ML with Intel Atom Z3580 SoC and 4GB of RAM

Benchmarking Asus ZenFone 2 ZE551ML with Intel Atom Z3580 SoC and 4GB of RAM Lenovo A7000 Preview

Lenovo A7000 Preview

Comments

Rules for posting